Income Tax Return form for assessment year 2013-14 has been released by Income Tax department vide NOTIFICATION NO. 34/2013 [F.NO.142/5/2013-TPL]/SO 1111(E), DATED 1. Now Banks issued Acknowledgement of Form-15H.We have uploaded below ITR 1- Sahaj, ITR 2, ITR 3, ITR-4, SUGAM (ITR-4S), ITR 5, applicable for Assessment year 2013-14 and Financial Year 2012-13.Income tax department issued income tax return form ITR-5 in excel format for assessment year 2013-14.

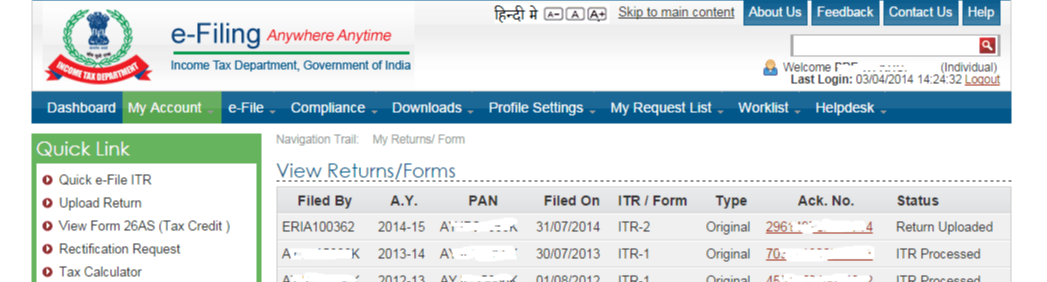

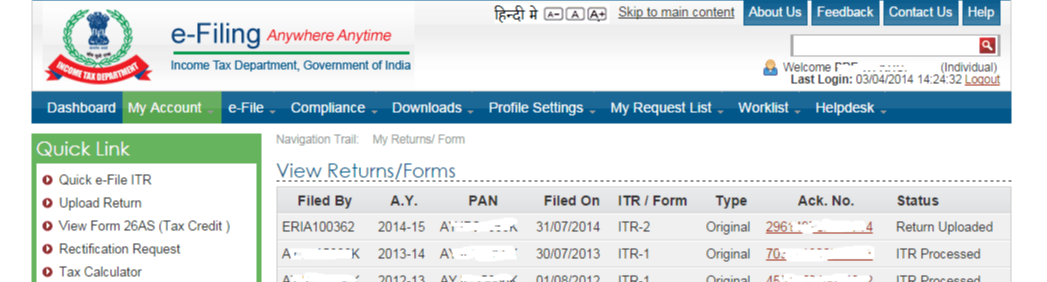

By on December 16, 2014 in After successful filing of your Return – you are required to send your ITR-V to CPC Bangalore. ITR-V has to be sent within 120days of your e-filing. You filed your Income Tax Return on time, but forgot to send the ITR-V? Unfortunately, unless you send your ITR-V, the department does not consider your return as filed.

Therefore, in the eyes of the Income Tax Department no return has been filed. You need to file a Fresh Return now, as if you never filed one! The good news is you can still e-file your returns for FY 2013-14. Do remember to send your ITR-V this time!

Here’s how you can send it Also note that when you file a delayed return it has some consequences, read here to know more about it Reach out to and we will help you out!

CA Pratik Anand Special Campaign by CPC-Send Signed ITR Acknowledgements/ITR-V for AY 2013-14 by 31 st October’2014 The Centralised Processing Cell (CPC) of the Income Tax Department has started a special campaign where it is reminding those who have filed their income tax returns for the AY 2013-14 without digital signature and have not sent the signed copy of the Acknowledgement to CPC Bangalore, to send the same to CPC Bangalore. The CPC has given last chance to those who have not sent the signed copy of the Acknowledgement, to do so by 31 st October’2014. Let us examine the provisions relating to signing of returns and sending of acknowledgements to CPC Bangalore and the implications of not doing so. Section 140 of the Income Tax Act’1961 As per section 140 of the Income Tax Act’1961, every return filed u/s 139 has to be verified by the following persons: Case I – Individual • By himself • If individual is not in India at the time of filing then by the person duly authorized by him on his behalf.

• If individual is lacking mentally to fill it, then it must be signed by his/her parent/guardian or any person who is adequate for it on his/her behalf. • If due to any other reason, individual is not in condition to do it, then it must be signed by a person duly authorized by him/her. Case II – Company • By Managing Director of the company. Due to any reason if the managing director is not available then any of directors can sign on the return form • If company is a non-resident company, then it must be signed by that person who holds Power of Attorney for it • If company is on wind up, then by should be signed by liquidator • If Government undertaking company, then it should be signed by the officer authorized by the government for this Case III – Firm • By authorized managing partner. Due to any reason if he is not available, then by any partners Case IV – Local Authority • By its authorized head officer Case V – Political Party • Chief Executive Officer or Secretary Case VI – Association • Chief executive officer of the association or any member of association It means that every return filed has to be verified by the concerned person. Libreoffice hardware acceleration vs opengl. The word ’verified’ has been substituted for the word ‘ signed’ by the Finance Act’2014. The word ‘verified’ has been added in view of the signing of the returns by electronic mode by the use of Digital Signature.

The series is generally spotless for a high school vampire love story. Twilight Saga is the addictive story of two young people –-Bella, a general young lady, and Edward, a flawless courteous fellow and who likewise happen to be a vampire. There's a cause why more than 10 million Twilight series books were published (only in print). Twilight fanfiction pdf download free. Chief, it is profoundly enthralling, quick paced story of sentiment and anticipation. This is the kind of book you may read in only a couple of sittings, getting to be fascinated in its fantastical world and careless in regard to your physical environment.

- Author: admin

- Category: Category

Income Tax Return form for assessment year 2013-14 has been released by Income Tax department vide NOTIFICATION NO. 34/2013 [F.NO.142/5/2013-TPL]/SO 1111(E), DATED 1. Now Banks issued Acknowledgement of Form-15H.We have uploaded below ITR 1- Sahaj, ITR 2, ITR 3, ITR-4, SUGAM (ITR-4S), ITR 5, applicable for Assessment year 2013-14 and Financial Year 2012-13.Income tax department issued income tax return form ITR-5 in excel format for assessment year 2013-14.

By on December 16, 2014 in After successful filing of your Return – you are required to send your ITR-V to CPC Bangalore. ITR-V has to be sent within 120days of your e-filing. You filed your Income Tax Return on time, but forgot to send the ITR-V? Unfortunately, unless you send your ITR-V, the department does not consider your return as filed.

Therefore, in the eyes of the Income Tax Department no return has been filed. You need to file a Fresh Return now, as if you never filed one! The good news is you can still e-file your returns for FY 2013-14. Do remember to send your ITR-V this time!

Here’s how you can send it Also note that when you file a delayed return it has some consequences, read here to know more about it Reach out to and we will help you out!

CA Pratik Anand Special Campaign by CPC-Send Signed ITR Acknowledgements/ITR-V for AY 2013-14 by 31 st October’2014 The Centralised Processing Cell (CPC) of the Income Tax Department has started a special campaign where it is reminding those who have filed their income tax returns for the AY 2013-14 without digital signature and have not sent the signed copy of the Acknowledgement to CPC Bangalore, to send the same to CPC Bangalore. The CPC has given last chance to those who have not sent the signed copy of the Acknowledgement, to do so by 31 st October’2014. Let us examine the provisions relating to signing of returns and sending of acknowledgements to CPC Bangalore and the implications of not doing so. Section 140 of the Income Tax Act’1961 As per section 140 of the Income Tax Act’1961, every return filed u/s 139 has to be verified by the following persons: Case I – Individual • By himself • If individual is not in India at the time of filing then by the person duly authorized by him on his behalf.

• If individual is lacking mentally to fill it, then it must be signed by his/her parent/guardian or any person who is adequate for it on his/her behalf. • If due to any other reason, individual is not in condition to do it, then it must be signed by a person duly authorized by him/her. Case II – Company • By Managing Director of the company. Due to any reason if the managing director is not available then any of directors can sign on the return form • If company is a non-resident company, then it must be signed by that person who holds Power of Attorney for it • If company is on wind up, then by should be signed by liquidator • If Government undertaking company, then it should be signed by the officer authorized by the government for this Case III – Firm • By authorized managing partner. Due to any reason if he is not available, then by any partners Case IV – Local Authority • By its authorized head officer Case V – Political Party • Chief Executive Officer or Secretary Case VI – Association • Chief executive officer of the association or any member of association It means that every return filed has to be verified by the concerned person. Libreoffice hardware acceleration vs opengl. The word ’verified’ has been substituted for the word ‘ signed’ by the Finance Act’2014. The word ‘verified’ has been added in view of the signing of the returns by electronic mode by the use of Digital Signature.

The series is generally spotless for a high school vampire love story. Twilight Saga is the addictive story of two young people –-Bella, a general young lady, and Edward, a flawless courteous fellow and who likewise happen to be a vampire. There's a cause why more than 10 million Twilight series books were published (only in print). Twilight fanfiction pdf download free. Chief, it is profoundly enthralling, quick paced story of sentiment and anticipation. This is the kind of book you may read in only a couple of sittings, getting to be fascinated in its fantastical world and careless in regard to your physical environment.